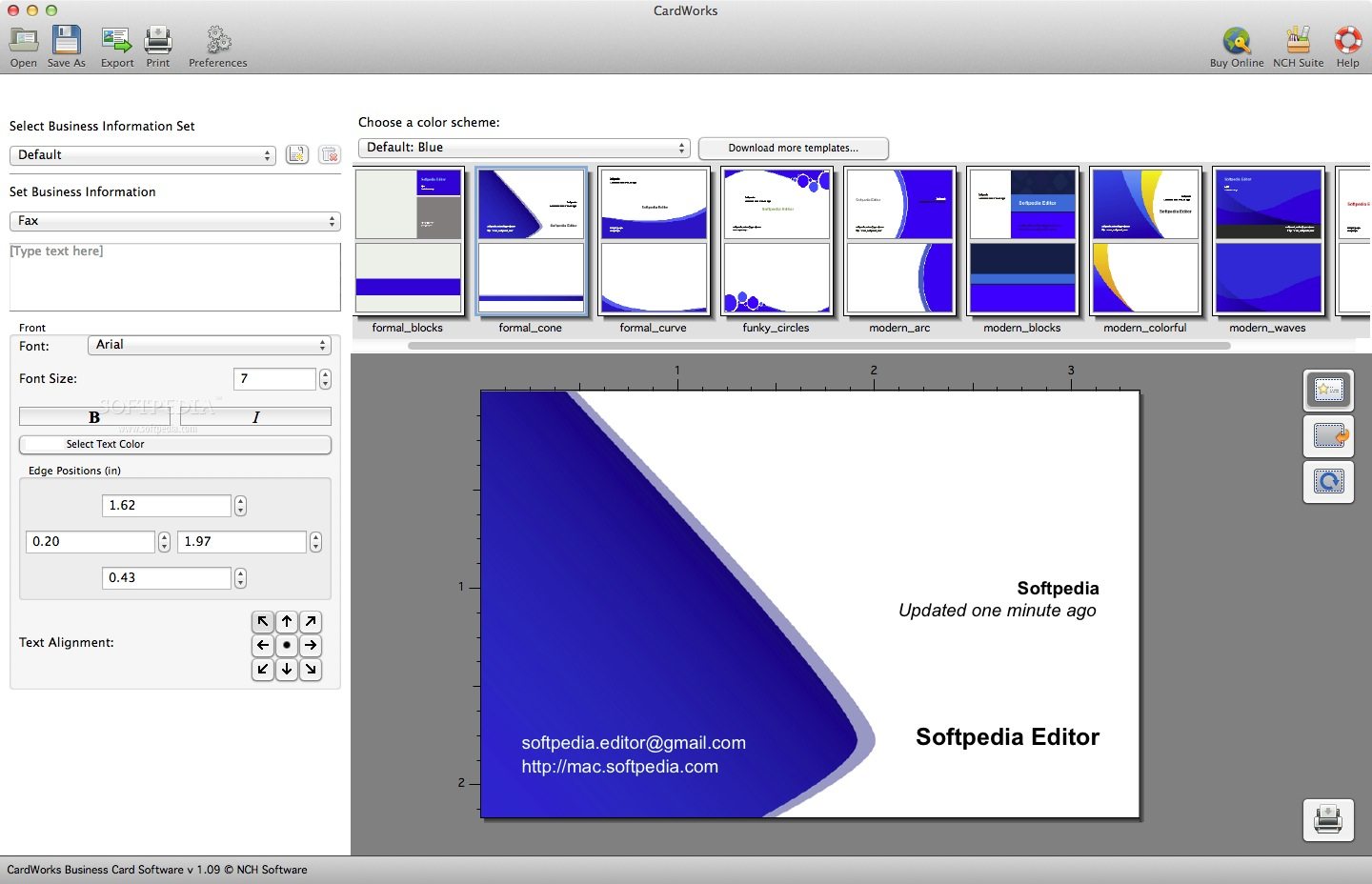

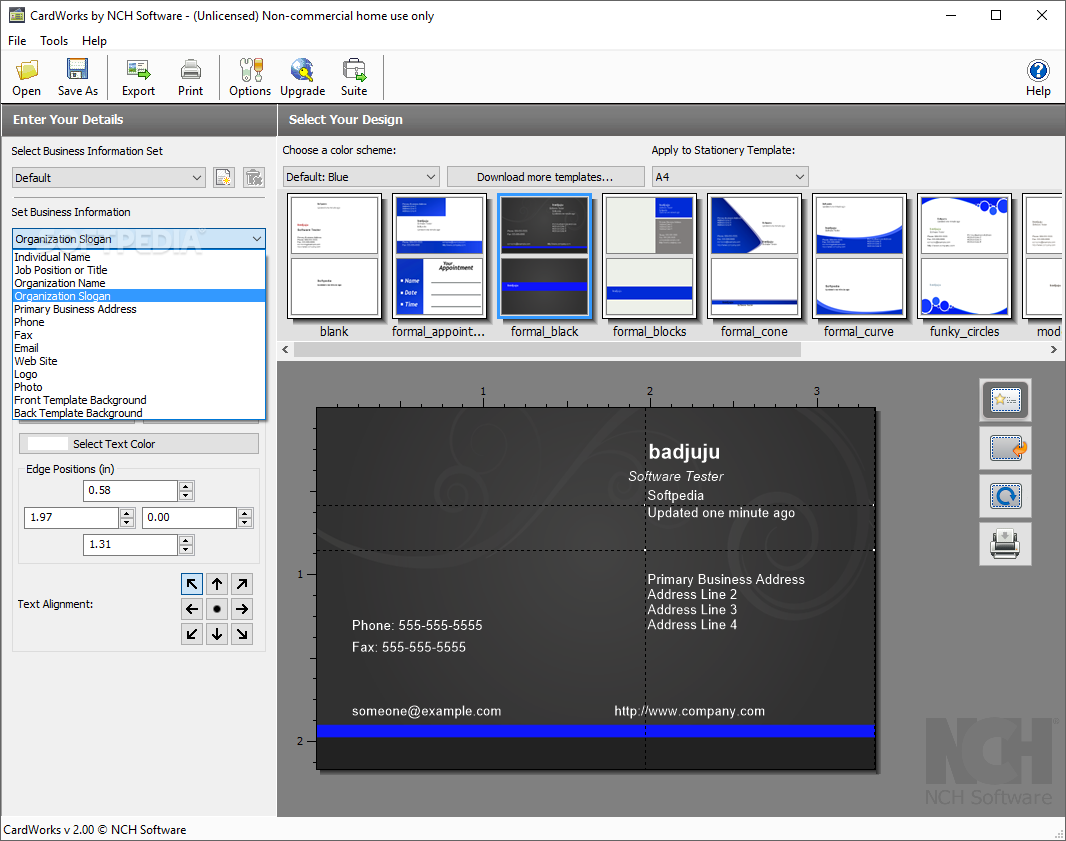

(NYSE: ALLY) is a leading digital financial-services company with $180.6 billion in assets as of December 31, 2019. While Merrick Bank specializes in non-prime consumer lending it is also a top-15 credit card merchant acquirer, clearing approximately $32 billion in transaction volume per year for 85,000 merchants and 42 independent sales organizations.Īlly Financial Inc. Merrick Bank also provides finance options to consumers through marine and recreational vehicle dealers throughout the country. Merrick Bank, founded in 1997 as a wholly owned subsidiary of CardWorks, is an FDIC insured top-20 issuer of Visa® branded credit cards. CardWorks is a leading servicer of nationally-branded MasterCard/Visa cards, private label cards, secured cards, and other unique products, as well as secured and unsecured installment loans. Wachtell, Lipton, Rosen & Katz served as legal counsel to CardWorks in connection with the transaction.įounded in 1987, CardWorks is a consumer finance lender and servicer, and a people-centric, compliance-focused organization enabled by data and technology. The acquisition, which is subject to customary regulatory approvals and closing conditions, is expected to close in the third quarter of 2020. "Culturally, Ally and CardWorks are ideal partners as both companies share a deep-rooted history of disciplined risk management and an obsession over the customer." "CardWorks represents an industry-leading credit card platform in the U.S., and this acquisition serves as an important milestone in Ally's evolution to be a full-service financial provider for our customers," said Ally Chief Executive Officer Jeffrey J. The company also offers securities-brokerage and investment-advisory services through Ally Invest, as well as a robust corporate finance business that offers capital for equity sponsors and middle-market companies. In addition, Ally's award-winning online bank ( Ally Bank, Member FDIC and Equal Housing Lender) offers mortgage-lending services and a variety of deposit and other banking products. The company operates one of the largest full-service automotive-finance operations in the country, offering a wide range of financial services and insurance products to automotive dealerships and consumers. is a leading digital financial services company focused on "Doing it Right" for its consumer, commercial, and corporate customers.

I am extremely enthusiastic about this acquisition and what it represents for our customers, clients, employees, and the communities in which we operate."ĭon Berman will continue to oversee the CardWorks business lines as part of Ally and will join Ally's Board of Directors and executive management team following closing.Īlly Financial Inc. "Ally is complementary to all of our existing consumer finance business lines, including our credit card and recreational lending businesses, as well as our merchant acquiring, third-party loan servicing, and recovery businesses. "The combination of CardWorks and Ally presents a tremendous opportunity for innovation, while we maintain a strong focus on our mission – which is to delight our clients and customers" said CardWorks Founder, Chairman and Chief Executive Officer Don Berman. Under the terms of the agreement, Merrick Bank, a wholly owned subsidiary of CardWorks, Inc., will merge into Ally Bank. merchant acquirer, the roadmap includes expanding Ally's product offerings in the non-prime segment, as well as enhancing their direct bank deposit and consumer product platform, and third-party servicing and recovery capabilities. As a leading non-prime credit card and consumer finance provider with servicing capabilities across the credit spectrum, a top-20 U.S. This combination will provide customers with a comprehensive suite of compelling secured and unsecured banking products.ĬardWorks is a privately held company headquartered in Woodbury, NY with facilities in Florida, Pennsylvania and Utah. The closing will bring together two customer-obsessed companies that are focused on "Doing it Right", with a shared common vision and aligned cultural values.

0 kommentar(er)

0 kommentar(er)